3 types of repayment schedules and which is best for you

When you’re making a smart investment, you’re taking a lot of things into account. The risks, the percentage… but time – time is often overlooked yet it is one of the most valuable assets a smart investor has. It’s a common mistake, both for beginners and financial gurus, to disregard time during their calculations and focus on percentages.

Time is the most important factor in the investment equation.

Here’s how to invest money and make time work for you – consider your repayment schedules. Distributing your financial flow over various periods of time will give you different results – each is awesome in its own way. Our team of devoted professionals here at Reinvest24 know the difference – and the value of each of the repayment types. We will now give you a profile on all three types of repayment schedules – pick one that works for you and your promising investment.

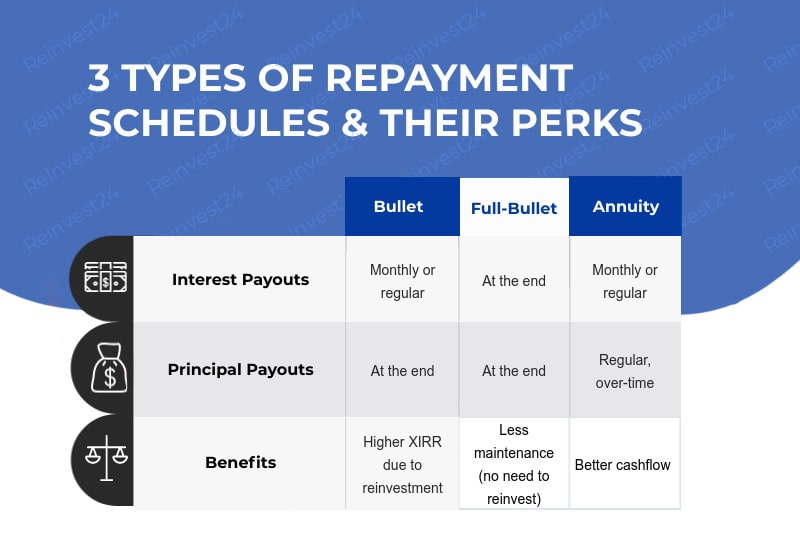

There are 3 types of repayment schedules: bullet, full bullet and annuity

No repayment schedule is better than the other – it depends on your goals, on your needs, on the character of your investment. Let’s go through all of them step by step and highlight the benefits of each repayment schedule.

Here’s a clear display of the repayment schedules’ key features. A quick comparison shows that each has its perks – you just have to choose the one that makes the most sense for you.

3 types of repayment schedules & their perks

Now, let’s take a closer look at each of those 3 repayment schedules – and we will help you make an informed choice and invest money the smart way.

By the way, you can choose to invest with either the bullet or the full-bullet reinvestment schedule right here, on Reinvest24 – but let’s go through the specs first.

1. Bullet repayment schedule – great for XIRR

The most common repayment schedule – Bullet – is all about time frames. With Bullet, you can set to receive your regular interest payments monthly, half-annually or annually, and then on the maturity date, you get a whole chunk of the principal back.

The gist is that Bullet ensures you have a stable passive income stream, with principal coming at the end of the term.

Bullet is – little payments regularly, a big finale and a chance for more.

Why choose this repayment schedule? It’s rational and it has a solid perspective – you can reinvest received profits and get additional profit. This tactic positively influences your XIRR. For example, investing in a 15% loan with monthly payouts results in 16.03% XIRR. We also touched on this topic in our recent blog post, explaining with a real example How reinvesting can increase your returns even more.

The Bullet makes the most sense if you invest in small businesses – while you get a money flow from the start, the business still gets an opportunity to accumulate income and grow.

2. Full-Bullet repayment schedule – one-time BANG

The Full-Bullet repayment schedule – a classic “all in- big win”-is similar to bank term deposits. Here, you lock away the investment until the final date of the project. The interest for the entire period will be paid out on the maturity date together with the loan principal. The Full-Bullet is, essentially, a big, juicy, opportunity-making snowball of interest and principal payout.

Full-Bullet is – little payments that add up with the big finale.

Why does this repayment schedule make sense? Obviously, it is a good discipline tool if you want to save money for long-awaited purchases or generate more capital for the next project. The received interest will accumulate, you won’t have access to it while the loan matures, and your patience will pay off on the maturity date.

The Full-Bullet schedule is most suited for development projects, aka building and construction, as they don’t generate any cash flow until the real estate development company has submitted the finished work. And once they do – you get your big win.

Like with any of the major properties we have here in Reinvest24 – you can choose a project, invest while it’s getting built and then – BLAM – right on the deadline, you get your big fat check.

3. Annuity repayment schedule – STAT profits

With Bullet and Full-Bullet repayments, the principal is returned back to the investor when the maturity date comes. The interest is calculated based on the total loan amount.

That’s the two reinvestment schedules we have at Reinvest24 – but some we’re planning on getting the third one. The Annuity.

With Annuity (also known as an amortizing loan), you get the principal back in regular payments, stretched over the period of the loan. In this scenario, the interest is calculated from residual loan amount (total loan amount less principal repayments, according to the schedule).

Annuity is the epitome of even distribution, especially when you need a stable income, and are not interested in waiting.

Annuity is – larger regular payments with no big finale.

Why Annuity can be the best repayment schedule? It guarantees a higher monthly cash-flow, although the total of the fund you get will be less than with the first two types of schedules. But the waiting tactic that the first two imply is also their weakness, as with Annuity, your funds become available much sooner, giving you a possibility to reinvest.

Amortizing loans make perfect sense if you’re planning on maintaining several projects and investing simultaneously. If at least one of your ongoing investments is on the Annuity schedule, you will always have a financial safety pillow.

How to choose the repayment schedule that is BEST?

So, we’ve been through all three repayment schedules and their best assets, and it’s time to pick one that makes sense for your financial flow. How to do it? Ask oneself 1 simple question – How long can you wait for your money? And yet again – time becomes a key factor in the process of decision-making.

If you want an income now, but you’re also ready to evenly redistribute – choose the BULLET. You will get a stable passive flow and a big value at the end of the term.

If you want to wait for a bigger snatch and reinvest – choose the FULL-BULLET. You will have a dry period, but the reward one the maturity date will be sufficient.

If you want a stable cash flow and return your fund asap – choose the ANNUITY. The funds will be flowing in regularly, although you won’t get more than you invest.

Evaluate your prospects, and you’ll see that one repayment schedule really makes the most sense for your situation – with all the info we provided you with, it should be clear as day. Keep in mind that time is your most resourceful tool – and invest confidently with Reinvest24.