The differences between investing in loans and real estate equity

By simply entering ‘real estate crowdfunding’ into Google, you will find millions of results. What you won’t find so easily is a clear, straightforward explanation as to what type of real estate crowdfunding each individual real estate investment platform offers. The main difference is that most platforms mediate real estate backed loans, whereas only a few offer real estate equity. So, let’s explore the main differences between crowdfunding loans vs real estate equity.

Loans vs real estate equity

The majority of real estate investment platforms are in the business of mediating loans. This means that your investment (the money you invest) gets put into a company, rather than the property that company is investing in. Other unique platforms, like Reinvest24, however, provide real estate equity, which is the similar to owning a percentage of the property you invest in. The latter will provide you with much more sustainable, high-yielding results, such as a monthly cash flow from rent.

Exploring the good and the bad of loan financing

Real estate backed loans, also known as real estate debts investments, are investments into, well, debts. Your money is destined towards a loan, taken by a company, to make an investment in a real estate project. When investing into loans, you’re essentially acting as the lender. Since these are usually short-term investments, you have various pros and cons. The main pro includes a shorter hold period, which means you’ll know exactly when you’re going to receive your returns and how much. The main con, however, is that you’re investing in somebodies efforts to earn profit rather than the potential value of a property.

Pros

- Easier to find clients, who want a loan (more projects, more often)

- Shorter hold period (fixed investment periods)

Cons

- Developments depend and rely on other projects (if one project fails, it can jeopardise the others)

- Fixed investment periods (your investment period is capped)

- Higher risks (what will happen when crises hits the market, or loan taker defaults)

- Return relies on the company/loan taker (rather than the value of the property)

Investing in real estate with real estate equity

Investing in real estate equity, which is what Reinvest24 offers, provides the same benefits of owning a property. In this case, you’re acting as a shareholder, receiving both short-term and long-term profits, especially when dealing with rental properties. For example, you will enjoy monthly returns from rent, as well as any rewards received from capital growth when eventually exiting your investment.

The biggest pro would include not having a limit on your return, which means more money in the long run. The biggest con, when it comes to real estate equity is that it’s a long-term investment, which means it takes time and patience to obtain greater returns.

Pros

- Same benefits as owning a percentage of the real estate (you own shares in the property)

- Passive monthly income (short-term profits from rental yield)

- Lower risk

- Access to exclusive property deals (you own part of a property you otherwise couldn’t invest in)

Cons

- Limited selection of properties (time-intensive investment which means less projects)

- Long-term investments (higher returns are obtained during longer periods)

- Property management (resource intensive, although Reinvest24 takes care of it)

- Slower payout (selling shares and receiving profits from capital growth can take time)

Which type of investment is riskier?

When comparing the risks, investments into loans mean that the development stages depend on a number of things. You need to take into consideration the financing, the loan taker’s (and such platform’s) other projects and all the due diligence that goes into making a geared investment through a crowdfunding platform.

When it comes to collateral, crowdfunding platforms that mediate real estate backed loans don’t always offer the property as guarantee and even if they do, the value is often a future estimation of it’s price. This means, if the loan defaults, the actual amount of monies recovered will depend on the progress of development works.

Recent announces of default of rather big lending companies on the market confirms, that the declared value of collateral is almost always lower than the actual loan. If it would be the other way around, then the loan taker could easily finance himself via bank loans and on better terms in most cases.

On the other hand, crowdfunding platforms that offer real estate equity always back your investment with the same property you are investing in as collateral. In Reinvest24 we always evaluate all potential risks of each property.

Investing in properties is safer than financing loans

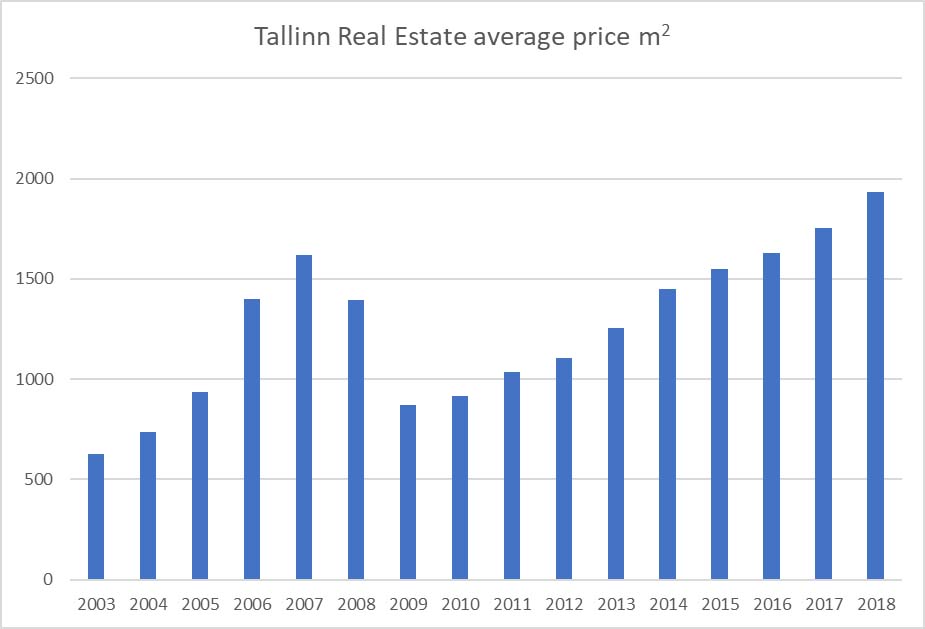

When you invest in rental properties with real estate equity, you benefit from rental yield on a monthly basis. This source of passive income is key to creating long-term wealth as it will withstand market fluctuations, ensuring a better cash flow. For example, at the peak of the last housing crisis in 2008-2009, the real estate prices in Estonia dropped up to 50-60%. Meanwhile, rental prices remained more stable, dropping only around 10-15%.

The fact is people still need somewhere to live, regardless of the economy. So, even if banks aren’t granting loans and there’s a decrease in real estate buyers, there will still be a solid rental market with tenants needing a place to call home. Rental income will ensure you endure and survive a market downturn, at least until real estate prices get back on track. Overall, the long-term price growth of properties for the past 15 years has been above 300% (housing crises period included).

Properties provides cash flow and long-term wealth

Even if there’s another housing crisis, investing in rental properties will still generate a healthy monthly cash flow while you wait for things to recover. And eventually, the real estate market always does. So, in terms of long-term returns on periods over 10 years, the market growth is still estimated to be at least 6% per year on average. This estimate includes the next real estate market correction period. When your long-term real estate investment provides rental yield, combined with capital growth, you are bound to receive great returns, with relatively low risks.

In comparison, when investing in loans, the next market correction or housing crises will leave the developers who are taking the loans in a sticky situation with interest rates over 10% and platform fees over 4%, and no rental yield to reward investors. If the developers are unable to sell their real estate, while paying an expensive mortgage with high interest, your returns are in jeopardy. Hence, the potentially high rewards come with high risks.

Get rich quick or get rich for life?

In terms of liquidity, investments into real estate equity can provide you with both long-term and short-term returns (especially when dealing with rental properties). You’ll even enjoy monthly rental income when the market is down. However, compared with investments into loans, it may take more time to enjoy your profits, as your returns will come from long-term periods, which is more sustainable if you’re looking for long-term wealth. In comparison, investments into loans are generally faster since they are short-term investments with fixed periods.

Should I invest in loans or real estate equity?

In conclusion, investing in rental properties will grant you a monthly cash flow to withstand any storm, and the real estate market eventually always recovers. However, when it comes to real estate loans, the investment can become a risk. Many loan takers and developers will never recover from a market correction, especially when using expensive high-interest loans for fast real estate developments. Investing into the loan deal can hold a huge risk when the market is not stable.

If you would like to invest in real estate through a crowdfunding platform that provides real estate equity, take a look at Reinvest24. We are a unique real estate investment platform based in Estonia. Our properties have been providing a total combined return of 14.6% per year, with encouraging projections for 2019. If you would like to start receiving monthly passive income, invest in real estate today, starting from 100 euros. Discover our high-yielding rental properties.