Estonian and Latvian Market Overview 2023

The Baltic countries Latvia and Estonia, have seen steady growth despite facing geopolitical challenges and high inflation. As the region moves forward into 2024, market participants remain cautious, resulting in slower construction volumes and general sluggish market activity. However, the Baltic capitals, insulated by low household debt and population growth, maintain a positive outlook for the future.

Estonia: Economic Recovery

Estonia faced a 1.3% economic shrinkage in 2022 but is projected to experience steady growth in 2023. The office space market saw new projects and expects further expansion in the coming years. Retail projects were limited in 2022, while the industrial sector witnessed growth due to increased e-commerce activities. Residential properties in Tallinn experienced significant price increases, driven by various factors. Meanwhile, the rental market saw a decrease in supply and increased prices, partly influenced by the refugee influx from Ukraine. But the rental prices have not increased much compared to the property prices, reducing the average rental yield from ~6% to 4-5%.

In 2022, the apartment market in Tallinn experienced contrasting trends. While the number of apartment deals decreased by 11%, indicating a decline in activity, the total financial volume increased by 8%, suggesting that higher-priced transactions contributed to the overall financial growth. On average, 190 new apartments were sold each month, accounting for 24% of all apartment transactions in Tallinn. This signifies that despite the decrease in deals, new apartments remained in demand.

In 2023, the housing market was expected to be impacted by rising interest rates, which could have implications for buyer affordability and market dynamics. However, despite the decline in activity, the average transaction price has continued to grow. In 2023 Q2 there were 2459 residential real estate transactions in Tallinn, with an average price of 3136 euros per m2. Compared to the Q1 of 2023 the average price increased 6,7%.

The majority of real estate deals take place in Tallinn and within a 25 km radius outside the city, particularly in districts such as Rae, Saku, Saue, Harku, and Viimsi. These districts have higher average prices, and there is an observable price increase based on location, especially in well-established private residential boroughs like Nõmme, Kakumäe, Pirita, and the districts bordering Tallinn. Over the past year, the popularity of Kiili and Saku districts has also increased, indicating shifting preferences and emerging opportunities in these areas.

The rapid slowdown in inflation is expected to bring relief to households in Estonia. When compared to other Baltic countries, Finland, Sweden, and Germany, consumer expectations in Estonia are relatively low. The impact of inflation on household deposits and consumption has decreased, as household deposits fell from their high levels in the middle of last year. While rising interest rates may have a short-term impact on households, the slowdown in inflation provides some relief. Euribor is expected to peak later this year, but the decrease will be gradual.

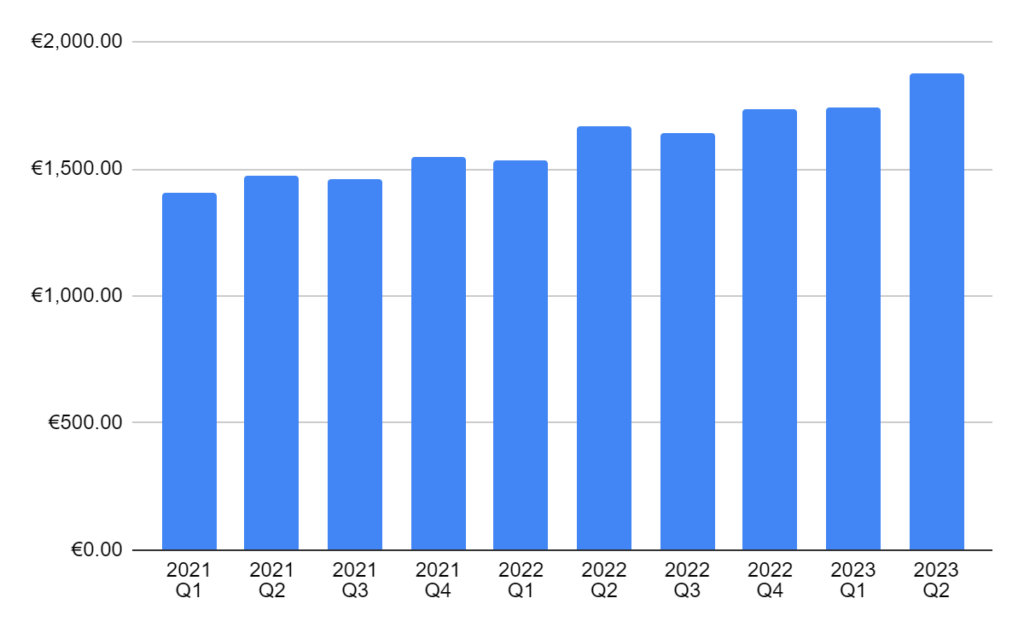

Despite the prolonged recession, the real wage in Estonia has started to grow in the spring of 2023. Strong wage growth is contributing to an increase in real wages, which positively affects consumption. The average gross salary reached 1981 euros in 2023 June, which is a new record high.

However, it is expected to take until next year for the real wage to fully recover from its previous decline. The labor market in Estonia has remained relatively stable, with high employment and moderate unemployment rates. Rising real wages, combined with favorable employment conditions, are expected to support household consumption. However, the growth of consumption will depend on the improvement of household confidence. While tax increases planned for next year may boost private consumption towards the end of this year, overall consumption this year is expected to decline. In 2024, private consumption is projected to increase, but its growth will remain below the long-term average.

Latvia: Navigating Challenges

Latvia initially had a positive outlook after the Covid-19 pandemic, but the forecasts now predict a shallow recession. Retail turnover increased, yet real net wages decreased. The office space market is expected to grow and stabilize rent prices, with companies favoring smaller, energy-efficient spaces due to the prevalence of hybrid work models. The residential and land markets experienced mixed results, with demand and prices fluctuating throughout the year, influenced by speculation and cautious consumer behavior.

The real estate market in Riga faced a shift in apartment prices during 2022. As demand for apartments decreased in the second half of the year, sale prices experienced a slight decline. However, overall apartment prices still managed to increase by 4.5% throughout the year. Prices for new apartments in the city center were higher, ranging from €2,900 to €4,300 per sqm by the end of 2022, while luxury projects and locations reached prices as high as €7,000 per sqm. Suburban new apartments were selling for €2,100 to €3,500 per sqm.

The real estate market in Riga faced challenges in 2022 for both developers and buyers. Various global events, such as the Russia-Ukraine war, had severe impacts on the market. The war initially caused a halving of real estate advertisement searches, but customers returned with renewed interest in the spring. Construction prices became unpredictable due to the war, and compact apartments with functional layouts gained emphasis. However, a shock occurred in the fall of 2022 when the Central European Bank raised interest rates, resulting in a slowdown in sales. Despite rising prices and interest rates, there is still interest in new projects, particularly energy-efficient housing.

The number of apartment sales transactions in Riga in 2022 saw a decline of approximately 4% compared to 2021. The war and its consequences, including unpredictable construction prices and inflation, affected demand. The beginning of 2022 showed a stable sales volume, and demand even increased during the summer. However, the sales slowdown occurred in the third quarter due to rising inflation, increased prices of construction materials, reduced availability of materials, and the European Central Bank’s interest rate hike. Many buyers were unable to afford loans, leading to a decrease in demand. The market saw an increase in series-type apartments as owners sold old units to purchase apartments from new developments.

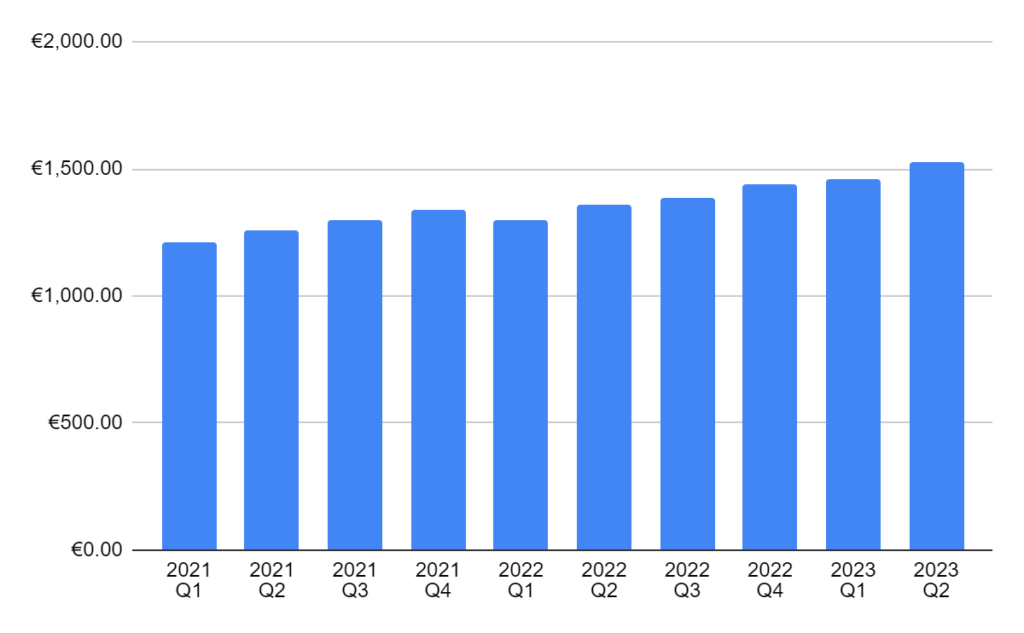

In 2023, Latvian wages experienced growth in line with inflation, indicating an improvement in purchasing power. However, private consumption faced challenges due to the high cost of living. While purchasing power has been gradually increasing since the middle of the year, a full recovery is expected to take some time.

The second half of 2023 is expected to bring a return to growth in the purchasing power of workers in Latvia. According to Swedbank customer data, nominal wages in June were already increasing at a faster rate than inflation. Although the high overall price level may continue to deter some consumers, the resumption of real wage growth, coupled with improved consumer sentiment, is anticipated to support private consumption in the future. Additionally, investment linked to EU funds is expected to provide a boost to the economy.

Conclusions

Despite challenges and caution from market participants, the Baltic countries continue to show resilience and adaptability in their real estate markets. With a focus on prudent decision-making and a positive long-term outlook, these countries aim to navigate and overcome economic and geopolitical uncertainties, ensuring sustainable growth in the real estate sector.

Estonia and Latvia are the local markets of Reinvest24, where we have the most experience and knowledge, resulting in a perfect track record for our real estate projects in this area. We have currently several ongoing real estate projects in those markets, and we are confident that we will complete them successfully and earn our investors above the market returns.