What’s going on with the housing market in Estonia?

When things are too good, people start to panic and ask questions. That’s exactly what is going on with the housing market in Estonia these days. Everywhere you go, you see large development projects and construction going on. The Euribor interest rates have been negative for some time now, which has increased the attractiveness of borrowing, but for how long will all the building and buying last? The leading Nordic-Baltic banking company, Swedbank, recently conducted a macro research showcasing some interesting points about the current and future housing market.

Is the housing market overheating?

In the research, conducted by economist Marianna Rõbinskaja, it clearly points out, “Although housing affordability in Estonia has improved, compared with the peak of the last real estate boom, it has stayed at the same level for the past four years.” This statement suggests that the real estate market is at a stable point. People can afford more, yet purchases aren’t fluctuating.

Households have more purchasing power

This is a good thing. Estonia’s economy has prospered over the years, and average salaries have increased. When people are doing well, it generally means they spend more. The study pointed out, “Households’ confidence in purchasing or building a home has improved in recent years.” However, it’s also important to point out that, “Households are more responsible in lending than ten years ago, and their risks are lower than in the last boom period.” This suggests people have learned from past mistakes, making today’s buyers more cautious.

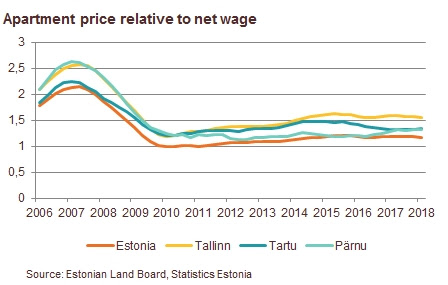

Housing prices in 2017 exceeded the 2007 peak

Swedbank’s study said, “Last year, prices of apartments in Estonia exceeded the peak of the 2007 real estate boom. However, compared with the peak of the last real estate boom, housing affordability in Estonia has improved. Ten years ago, the average net wage growth could not keep up with the average apartment price growth, which was more than twice as rapid as the growth of the average net wage making the purchase of real estate for consumers less affordable. Currently, the overall situation on the housing market is more favourable for homebuyers and their risks are lower than ten years ago. Households’ confidence in purchasing or building a home has improved in recent years, and we expect that demand for housing should remain high, at least in the near future.”

In other words: Prices are at an all-time high, yet things are definitely better than 10 years ago. People can afford more. So it looks like the demand for housing will continue… for now.

Could this be the calm before the storm?

We’re not implying something bad is about to happen, on the contrary, we think this might be the calm before great activity. Things have been so stable for the past 10 years that things are bound to change in the future. Swedbank’s research states, “Although, market interest rates are expected to move upwards soon, they will remain quite low. Thus, the favourable interest rate environment will continue to encourage borrowing.” So, maybe people are just waiting for the right buy as opposed to the right time?

The future looks bright for the real estate market

There’s never been so much on offer! The macro research highlighted how, “Activity in the construction sector is at the highest level in recent years – nearly 8,000 building permits for dwellings were issued, and almost 6,000 new dwellings were built last year. Nearly half of all the building permits and use permits for dwellings are being issued in Tallinn.” So, with an increase in purchase power and real estate offerings, it is safe to say that people will continue buying real estate as primary residences and as investments in the coming years.

In conclusion, the real estate market in Estonia is currently stable. Prices are high, buyers are in a favourable position and there’s a lot on offer… and it looks like things are going to stay like this for a while. Sounds like a great time to start investing in real estate!