How reinvesting at Reinvest24 can increase your returns even more?

As long as investments have existed, investors tried to maximize gains and minimize the cash drag. Even the legendary quote says it all – “The time is money”, so don’t underestimate the value of your time, especially, when it comes to investing. But what does that really mean? Let’s take a closer look and find out how to make sure your investments are firing on all cylinders.

What is reinvesting?

Reinvesting is one of the most powerful weapons in the investor’s toolbox. It stands for putting any of your income that certain property generates to purchase additional shares, thus making your money work for you again and again. Despite the fact that having a little extra cash on hand may be appealing, reinvesting can greatly pay off in the long run. The biggest case for reinvesting dividends is the power of compounding returns over time.

In fact, the brightest example of using compounding returns is the greatest business tycoon of all times – Warren Buffett.

One of his first investments was in high school when he and his friend bought a second-hand pinball machine for $25 and installed it in a barbershop. The game proved to be popular with everyone that came into this barbershop. As a result, the entrepreneurial duo reinvested their profits to buy more game machines. In time, they had eight machines in several shops. When the right time came, they sold the venture, and Buffett used his stake to buy the stock for a new business endeavour. By the time he was 26, he’d accrued $174,000 – or $1,692,352.84 dollars’ worth of value in 2021 equivalent.

Here is some of the math to prove this strategy working.

Same 1000 EUR – different investment approaches?

Let’s take as an example investing 1000 EUR in one of our Moldovan projects – Metropolis Business apartments – and see what scenario would bring You more returns?

Option 1

The project description states the following conditions:

- IRR – 15%

- Duration – 12 months

- Monthly payouts

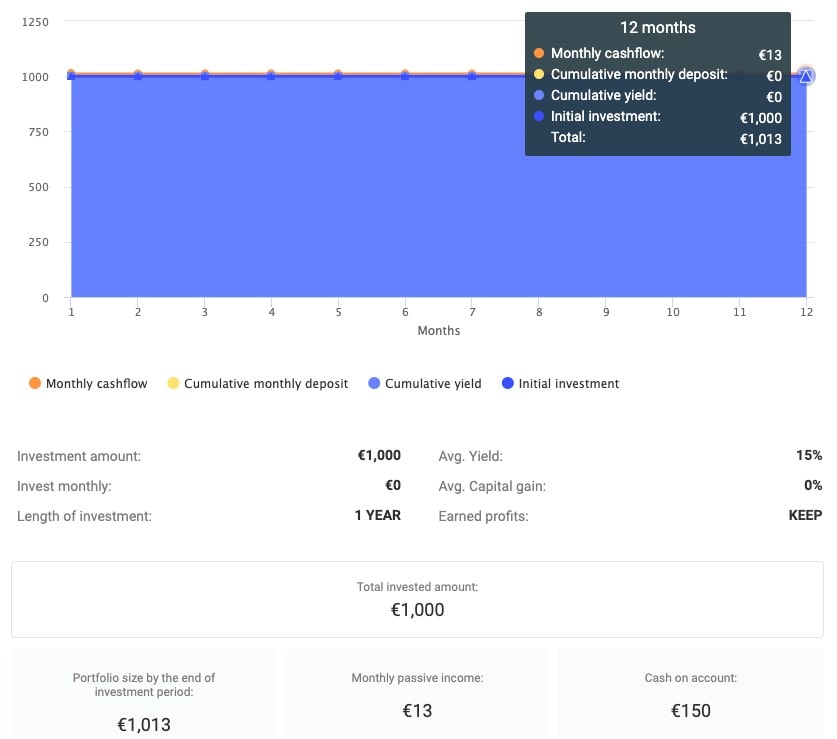

If we invest 1000 EUR in this project and hold it for 12 months, at the end of the loan term, your money will earn you a profit of 150 EUR. Our investment calculator will help us to calculate all the numbers in the blink of an eye – kindly see the screenshot below.

In the mentioned scenario, every month You will receive 13 EUR in monthly payouts and the total balance at the end of the period will be 1,150 EUR.

Option 2

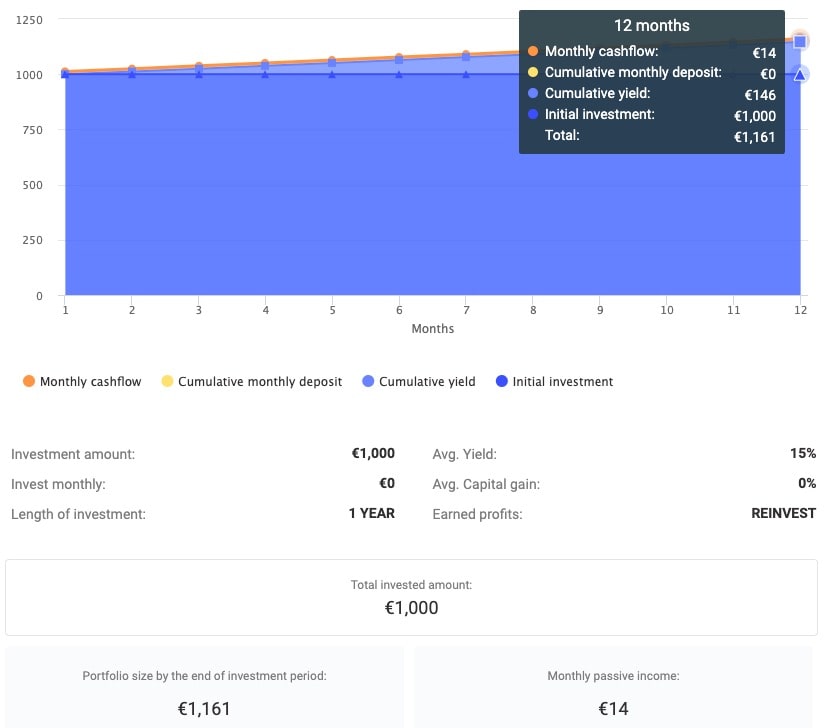

In the second scenario, we have the same conditions, but now we will try to reinvest our monthly payouts of 13 EUR and see what happens.

Reinvesting creates growth

The performance difference comes from reinvesting. To put it simply, every time, when receiving monthly payouts or property repayments, you are adding 1 more violin to play for your financial orchestra. This means that reinvested claim units would also have gained you the interests.

Apart from that, every time you might want to withdraw, you incur costs such as 2 EUR withdrawal fees and taxes, which can quickly reduce any additional returns you’ve gained on both the purchase and the sale. Coming back to Option 2, we see that reinvesting income turned out to gain 14 EUR per month and 1,161 EUR for the same period of time, at the end of the loan term, which is for 11 EUR more than without reinvesting.

For some, it might look to be not a big difference, but when it comes to bigger amounts, the difference is more noticable. It’s 7.3% more in earnings compared to the first option, and it’s only the difference for 1 year. Besides, a true investor uses all the options provided.

To have a broad picture of how it works, do not hesitate to check different principles, loan durations and interest rates, while using our investment calculator, thus choosing the strategy, that fits your needs the best.

Read more about where does investing 100 euros per month get you or how to become a millionaire.

Crowdfunding solutions made investments in real estate easier and created simple techniques that can help investors build up their returns. When it comes to reinvesting smaller amounts – even as little as 1 EUR – Reinvest24 secondary market will be your greatest helper. More information on how it works you are able to find in this guide.

3rd-anniversary Cashback

Whether or not you should reinvest your real estate income depends entirely on the goals you set for yourself. If you are content with what you have, you may feel no need to reinvest your profits. If, however, you are interested in realizing financial freedom and retiring with enough money to live the life you want, you may consider putting it to work again. And it becomes twice pleasant if you are able to use additional bonuses to reach your goals sooner. This year Reinvest24 started to celebrate the 3rd anniversary a bit earlier, giving you a true chance to juice your investment returns. Until 12.05.2021 (included), invest in our projects on the primary market and receive the following cashback bonus from your total investments.

- 0.25 % on investments up to 1’000 EUR

- 0.5 % on investments from 1’001 to 5’000 EUR

- 0.75 % on investments from 5’001 EUR

To participate in the campaign, please read the terms and conditions.