Q2 2020 property overview

In the past, our property quarter overviews were sent via email only to users who are invested in a particular project. Starting from Q1 2020, the overviews of our rental properties are available for everyone. We believe that this will increase the transparency and all our investors will have a better overview of what’s happening with the properties on Reinvest24 – real estate crowdfunding platform. It is very important as the secondary market launch approaches and all investors will be able to invest in already working properties in the very near future.

Let’s see what is Q2 property overview all about.

In overall the Q2 of 2020 was definitely not the best 3 months, as 2/3 of this period was the peak of COVID19 and the lockdown was applied by the governments. Some sectors took a bigger hit than others, but everyone was effected one way or another. Real estate in overall was one of the asset class, that did a lot better than the rest. In May we already saw a recovery in Tallinn market and that trend has continued in June and July. For our rental properties in most part, the impact has been very small, but due to low activity on the market, some processes have been taking longer than expected.

High yielding office space in Rocca Al Mare property overview

Income and costs:

| April | May | June |

| Gross rental: 3633 EUR | Gross rental: 4005 EUR | Gross rental: 4378 EUR |

| Platform fee: 0 EUR | Platform fee: 0 EUR | Platform fee: 169 EUR |

| Profit: 3633 EUR | Profit: 4005 EUR | Profit: 4209 EUR |

| Payout: 3633 EUR | Payout: 4005 EUR | Payout: 4209 EUR |

- Until the property was fully funded, the monthly rental payouts were proportional, based on the days user was invested in the previous month.

- Until the property was fully funded, Reinvest24 did not take any management fees.

- We plan to keep this property long-term, as the property is well secured with a good rental contract for the next 8 years period and has a great potential for capital growth!

- COVID19 lockdown had no effect on rental income!

Restaurant and wine boutique commercial space in Kadriorg

Income and costs:

| April | May | June |

| Gross rental: 600 EUR | Gross rental: 1750 EUR | Gross rental: 2333 EUR |

| Platform fee: 0 EUR | Platform fee: 0 EUR | Platform fee: 233 EUR |

| Profit: 600 EUR | Profit: 1750 EUR | Profit: 2100 EUR |

| Payout: 600 EUR | Payout: 1750 EUR | Payout: 2100 EUR |

- This property has a tenant who suffered from the COVID19 lockdown. The restaurant was partially closed in April and could only offer “takeaways”. They opened doors again in mid-May. Therefore we accepted their request to postpone some part of April and May rental payments to the second part of the year. This will not have any negative effects on the total rental income in 2020.

- The new appraisal report is planned for the second part of 2020. The new appraisal report will be made, once the purpose of the property is changed to commercial space (notarial obligation of the previous owner).

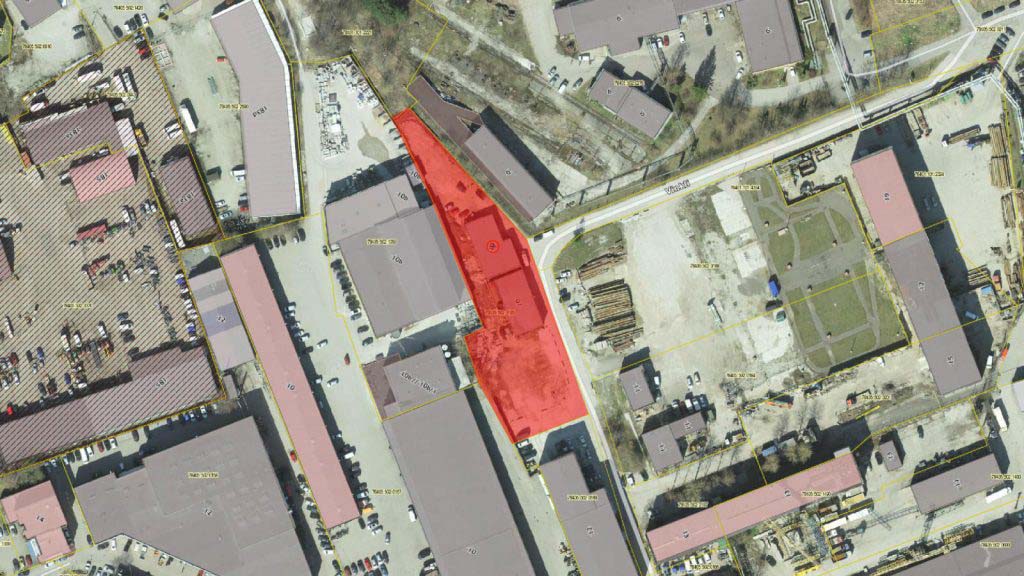

Land plot with existing cash flow and development potential

Income and costs:

| April | May | June |

| Gross rental: 1900 EUR | Gross rental: 1900 EUR | Gross rental: 1900 EUR |

| Platform fee: 190 EUR Other costs: 20 EUR | Platform fee: 190 EUR Other costs: 20 EUR | Platform fee: 190 EUR Other costs: 20 EUR |

| Profit: 1690 EUR | Profit: 1690 EUR | Profit: 1690 EUR |

| Payout: 1690 EUR | Payout: 1690 EUR | Payout: 1690 EUR |

- Net rental yield in 2020 Q2: 7,44% (01.04.2020 – 30.06.2020)

- In the past 6 months we have been in contact with real estate developers who are interested to build on this land. We already have some options on the table and most likely the profitable exit will happen within 2020.

- COVID19 lockdown had no effect on rental income!

Land plot with cash flow and signed buyout

Income and costs:

| April | May | June |

| Gross rental: 1300 EUR | Gross rental: 1300 EUR | Gross rental: 1300 EUR |

| Platform fee: 130 EUR Other costs: 20 EUR | Platform fee: 130 EUR Other costs: 20 EUR | Platform fee: 130 EUR Other costs: 20 EUR |

| Profit: 1150 EUR | Profit: 1150 EUR | Profit: 1150 EUR |

| Payout: 1150 EUR | Payout: 1150 EUR | Payout: 1150 EUR |

- Net rental yield in 2020 Q2: 6% (01.04.2020 – 30.06.2020)

- The latest exit date for this property is 2021 May, but currently it seems that we are going to be able to finalize the preliminary agreement within 2020.

- COVID19 lockdown had no effect on rental income!

Rental apartments in Tallinn´s tech hub

Income and costs:

| April | May | June |

| Gross rental: 0 EUR | Gross rental: 0 EUR | Gross rental: 0 EUR |

| Platform fee: 0 EUR | Platform fee: 0 EUR | Platform fee: 0 EUR |

| Profit: 0 EUR | Profit: 0 EUR | Profit: 0 EUR |

| Payout: 0 EUR | Payout: 0 EUR | Payout: 0 EUR |

- Currently the property is not rented out and does not generate monthly income.

- The lockdown has caused the operator to renounce the operations, we are in progress of selling this property as two separate units.

- The property could have been rented out long-term, but that would have made it difficult to sell it at the same time.

- The capital growth is going to compensate “no income period” for our investors.

Modern office in the business center of Tallinn

Income and costs:

| April | May | June |

| Gross rental: 0 EUR | Gross rental: 0 EUR | Gross rental: 0 EUR |

| Platform fee: 0 EUR | Platform fee: 0 EUR | Platform fee: 0 EUR |

| Profit: 0 EUR | Profit: 0 EUR | Profit: 0 EUR |

| Payout: 0 EUR | Payout: 0 EUR | Payout: 0 EUR |

- Currently the property is not rented out and does not generate monthly income.

- The key factor for this property is the purchase price, which would not have been possible if the property came with a valid rental contract.

- Currently the property is not owned by Reinvest24 SPV, as it is not purchased yet, but is reserved through a notarial agreement.

- The lockdown has extended the period for finding a good tenant for this property. We have decided to lower the rental price for the first year, to speed up this process. To compensate to our investors, Reinvest24 will not take the management fee for that period.

- As of 24.07, there is one very seriously interested company in the same building, who is expanding and needs additional office space. We hope to give you good news about this in the very near future.

- The capital growth is going to compensate “no income period” for our investors.

You can read more about how the Reinvest24 platform did overall in the past 3 months in our blog post: Reinvest24 Q2 2020 overview

Are you looking for an investment strategy where the monthly cash flow of dividends is in the foreground? Then Reinvest24 real estate crowdfunding platform is the best choice of yours. Seed your future profits now.