Should I invest now or wait for the next market crash?

So you would like to make an investment in real estate but keep hearing all these things about the market crashing. Should I wait? Nonsense! You have no idea when the right time is going to arrive. Meanwhile, you’re losing money and opportunities every day. The truth is, there’s no better time to invest your money than right now. Nothing good comes from just sitting on money. It will depreciate or you will end up spending it over time. The only real way to save that money and make it grow is by investing it in projects with high yield. If there’s something all the millionaires in the world have in common, it’s that they all invest their money. And they do it wisely!

You can’t know for certain when the market fluctuation is going to stop

The right time is always obvious when you have an opportunity, the price seems fair and there’s nothing stopping you. The in between moments are the ones which are hard to predict. Are prices going to go up tomorrow? Or are they going to keep going down. Unfortunately, you’ll never know until it’s too late. That’s why it’s always a risk. Depending on your risk tolerance, you’ll either dare to take the plunge (and potentially succeed) or you’ll wait, in which case you’ll definitely lose.

You’re losing money by waiting

There is always a cost involved with waiting to invest. Time is money, right? If only we could predict the future. Then we would all be making passive income. But unless you’re a market expert, you won’t know when the market has finished dropping and when it’s the perfect time to start investing. Meanwhile, every day, month and year that you wait, you are missing out on passive income opportunities. And sometimes market corrections take years! Your risk tolerance may be low, but by being scared of losing your money, you’re actually really losing your money.

Research agrees

Bloomberg (the leading software company delivering market news) even runs simulations on whether it is more profitable to invest right away or wait for a market downturn. The results show that you definitely lose more by waiting and holding on to your cash, in comparison to those who invest their money and hold on to their assets.

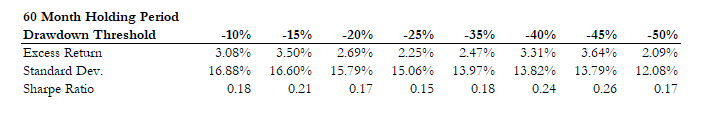

Furthermore, with the current inflation rates, the money you’re holding on to will continue to lose value over time. Research has shown that by waiting, instead of investing, you’re actually losing more money than you could be making. For example, between 1926 and 2016 the US stock market returned 6.3% over cash. The research compared investors who waiting 5 years to invest after a market crash (followed by a market correction) compared to investors who held on to their stock throughout the entire period. The research showed that the returns of those who waited were only half of those who held on to their stocks. This is the chart from the research. Excess returns are returns over cash (whereas the buy and hold average is 6.3%).

Hence, it doesn’t matter if you wait for a 10% market correction or 50%. By waiting, you are still losing out on money you could be making, either way.

There’s no such thing as ‘the right time’

Keep investing at all times! To secure your money and make sure you take advantage of all the moments when the market is at its lowest, you should invest constantly. As often as you can, and obviously whenever you find a good opportunity or project. This way you get to benefit from every part of the cycle, going up and coming down. Every day is an opportunity. You just need to realise what kind of an opportunity.

Trust the numbers

Whenever you make an investment, it’s important to figure out what the projections are. The media and society will always have an opinion on how high or low the market is. What’s important is to figure out the yield of your investment and base your decisions on actual figures (rather than opinions). It is also important to check how your investment is protected over time.

In conclusion, waiting for a long time is never good for your money. You should always do your research and due diligence, but there’s no such thing as the perfect moment to invest. This depends on so many things. The best moment to invest your money is when you have it available and when you find the right opportunity. That’s it!

Do you think it might be a good time to become a real estate investor? Discover your investment opportunities right now!