Is the Baltics Real Estate market about to crash? Key webinar takeaways

What currently happens on the Baltics Real Estate market? Are we expecting the next market crash? To find that out, we invited our industry colleagues – CEO of Bulkestate – Igors Puntuss, Lars Wrobbel – Passives Einkommen mit P2P and Andis Birins – OBER HAUS Latvia Representative to join our CEO Tanel Orro in an open discussion. The whole video is available here. But with this post, we would like to summarize 50 minutes in key webinar takeaways.

COVID-19 impact on the real estate market

The one is clear – the recent pandemic situation affected the real estate market. In April, Sales transactions dropped around 43%, compared to last year. Many interested buyers couldn’t visit the properties or took time to consider the purchase. As a result – the whole selling process slowed down. If someone wanted to sell something fast, they were obliged to lower the price by 10%.

The rental market was hit hard as well, especially short-term (Airbnb) apartments, due to the whole tourism sector being on pause. Many apartment owners started to adapt to these circumstances, therefore many apartments were rented long-term.

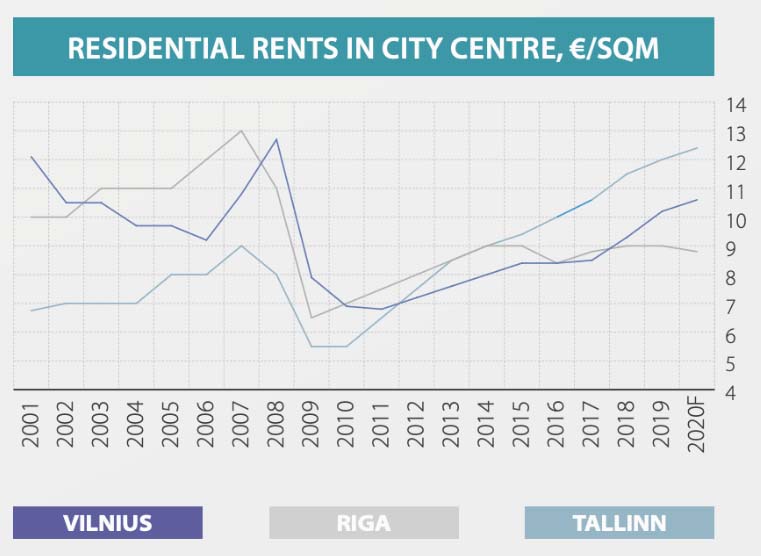

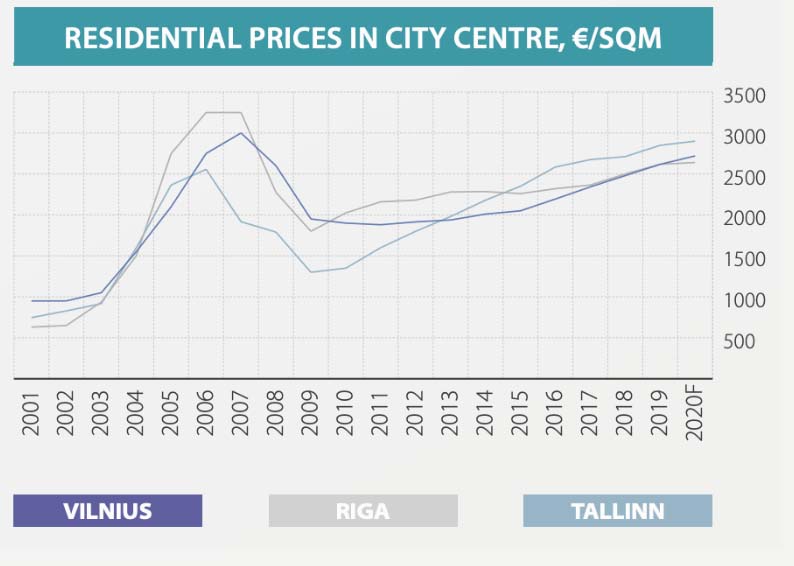

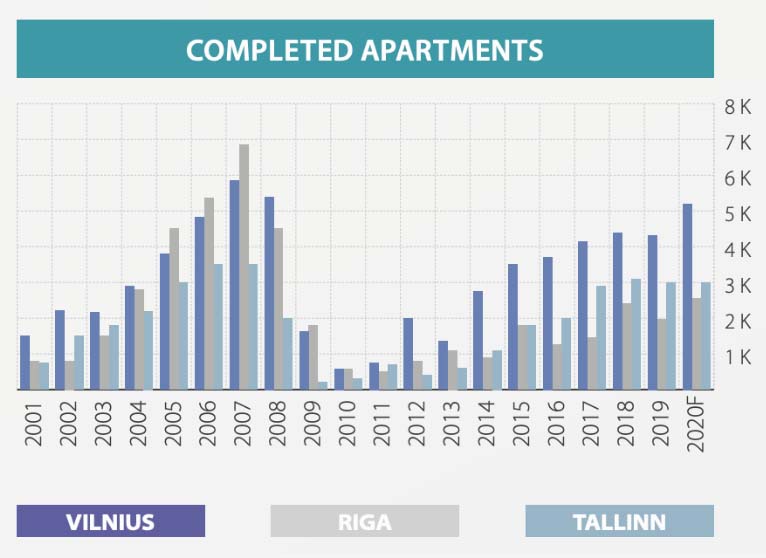

To make picture clear – here are some statistics.

Residential rents in city centre

Residential prices in city centre

Completed apartments

Recovery, recovery, recovery

Despite the downturn, in May, the market starts to recover. The Sales Transactions showed an increase in prices by around 3.5% compared to April. And compared to last year May, the prices increased by around 9.6%. If we talk about small size modern apartments then the market is active right now and we at Reinvest24 were even able to sell 3 apartments. Another trend we see on the market is that the companies are looking to sell their offices and rather are considering renting options. It was done in order to free some capital that can be used for overcoming the current situation or developing new technologies that can help companies grow. So, this is also a good sign of the recovery period for the office rental market.

What does this mean for investors?

For investors, it brings the greatest opportunities, as platforms started to offer higher interest rates, which do not necessarily correlate with a high risk of the projects.

Also, taking into account the latest p2p industry news, retail investors become more educated in terms of choosing the platform for investing. Many starts doing their own due diligence and overall become aware of the risks that p2p investment industry may possess.

Read more on How to make sure you are not being scammed?

And platforms?

As per platforms, many received more interesting projects to consider, even from more experienced real estate developers. The reason for that – it simply became harder for developers to get a loan from the bank. Besides, the waiting time of receiving an answer (which may be negative as well) became longer. Also, platforms became more cautious regarding the LTV (Loan to Value) and valuations. The quality of properties increased or stayed as good as before but their LTVs became lower. In some cases, even collateral value is not enough anymore.

As per Reivest24, we need to have a long-term understanding of the rental demand, the overall market situation of the region as well as the liquidity on the market. Before offering the property for investments, we must be sure that in 2-3 years’ time it will not cause problems. Of course, we are not able to predict the future, but the risks that our properties possess should be lowered as possible. And that’s our all-time priority number one.

In addition, platforms became more open and started to build even closer relations with their customers. And here Reinvest24 may be the one to watch, as recently we have implemented many overview series with one goal – make investors up-to-date with everything that happens with their investments. For example, now we are sharing the latest updates on our development projects in our Insider updates, and providing quarterly updates about the rental properties in our property overviews.

Consumer loans vs. Real Estate

But what about comparing these two types of investments? What is the main difference? Security is the answer. Real estate loans are more secured, as in the end there is always a property behind it. If the consumer loan or business loan goes bad in times like this, there is not so much hope to recover it, but if the real estate investment goes bad – there is collateral in place which always can be transferred to repay the obligations. In other words, the chances to recover your real estate investments are big, just some time is needed.

Is real estate market overheated?

When checking the stability of the market, many indicators should be observed. One of them is the sqm price per average income.

For example, in 2005, the average salary in Estonia could get around 0.4 sqm of the real estate in Tallinn. That was before the big growth and the crash in 2008. By the end of 2019, 15 years later, an average salary in Estonia could actually give a 0.8 sqm of the real estate in Tallinn. So the average salary could get two times more which indicates that the overall economy in Estonia has been growing faster than the real estate market. In other words, it is a good sign that the market is not overheated.

So, Is the Baltics Real Estate market about to crash?

Despite the fact that the longer-term effects of the crisis may be visible only over some time, at the moment, the market starts to recover and is accelerating rapidly. When compared to the crisis of 2008, we are nowhere near it, as it was a fully different situation. The governments, central banks are supporting businesses and overall are ready to help the economy to get back on track. So we are looking forward to what the future will bring to us.

We hope that this webinar helped you to gain more insights into the current real estate situation in the Baltics States. Stay safe!