Rental projects – the undervalued investment with huge potential (part 2)

Welcome back to diving deeper into the concept of rental projects. In part 1, we explained the overall information about this project type and now will have a closer look at the risks and securities.

Key takeaways

- The risk factor – this type of project basically has no possibility for the property to default;

- You can exit the projects whenever You want. Selling it per nominal price on our secondary market will take only a few minutes;

- To date, zero of our projects defaulted and we were able to successfully exit numerous projects with great capital growth;

- Investing in rental projects on our primary market is cheaper than on the secondary market;

The main advantage – its risk factor

Let’s talk about the risks that investors might face. The biggest advantage of the investment type is in its risk. There is basically no possibility for the property to default. In fact, the only debt that this kind of project has is an investor’s debt, while the good old consumer loans have several levels of borrowers.

So, once the project is funded, the SPV is created. All the SPVs are independent and their risks are not transmitted to each other. The SPV manages all the cashflows like rental payouts and expenses accrued. Additionally, it means that in the case of some other project facing any challenges, they are not transmitted to the platform itself or any other project. Even if something bad happens to the platform, the project is managed separately. It means that it will be possible to still sell it and get the money back.

Still, how does Reinvest24 secure Your investment?

Right after purchasing the property, the collateral agent will put the 1st rank mortgage on the property with the +20% valuation from the funding target and it will hold it in the favour of our investors. The collateral agent will not allow any other transactions with the property. Also, he will make sure that the profits are distributed to the investors. For example, if the SPV is receiving a rental income but does not pay it out to the platform, the collateral agent will have the right to take over the property with a single purpose – to sell it at the best possible price and distribute the funds back to the investors.

Our track record says it all

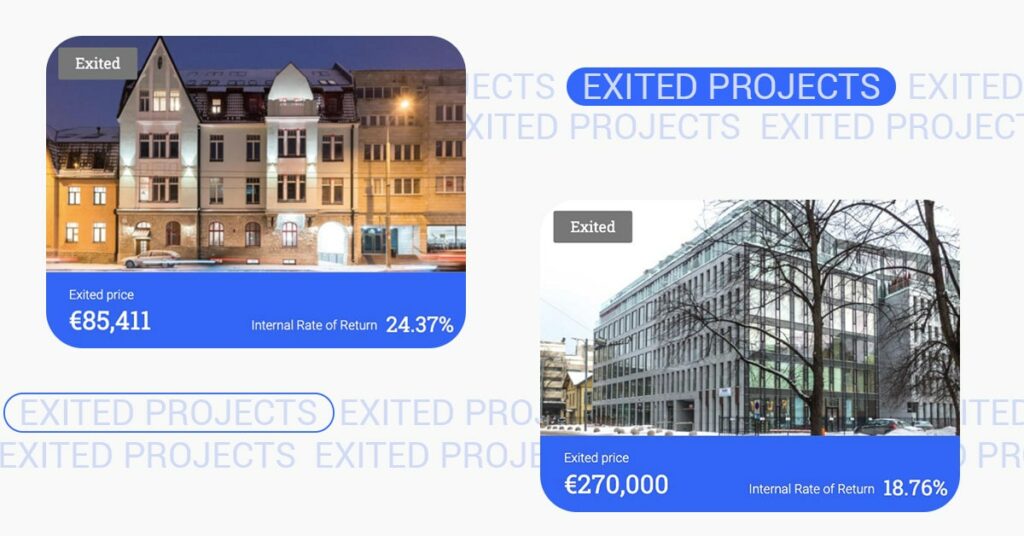

Speaking of exits, even in times of COVID, when the platforms and projects in the industry collapsed one by one, the quality of our risk assessment proved itself well. In fact, zero of our projects defaulted and we were able to successfully exit numerous projects with great capital growth.

Moreover, the exited projects showed even better performance than we were estimating before. For more information case by case, kindly visit our exited projects blog section.

Read more about How we choose the right investment objects

The primary market vs secondary market

Considering all the benefits that this project type gives, only a limited selection of them becomes available on our platform. It is not happening often and when it does, you better not wait for long.

Even though the minimum investment on the platform is 100 EUR, it is worth considering higher investment amounts. Why? The funding target of these projects is relatively higher therefore it takes time to fund it. As you probably might know, time is money and the longer it is in a funding stage, the longer your investments stay without really working for you.

Besides, you can always exit from your investment by selling the claim units on our secondary market. Taking into account that prices per rental project there are relatively high, it will take you a few minutes to sell it per the nominal price.

As You can see, rental projects are quite outstanding. We are extremely happy that a couple of years ago we created Reinvest24 with one mission – to make great real estate investment projects accessible to everyone.