Rental projects – the undervalued investment with huge potential (part 1)

Reinvest24 is constantly growing by adding new investment types, covering unique markets, and welcoming new investors. Not many will remember that at Reinvest24 it all started with rental projects – a unique concept for the alternative investment industry. We decided to educate our new investors, as well as remind our experienced ones what the rental projects are and what benefits they provide.

We will cover this topic in two articles. In part 1. we explain the overall information about rental projects. In the 2nd part – the security of this type of project.

Key Takeaways

- Rental projects give You the best characteristics of being a property owner, without legally being it. You don’t face any additional costs, operational headaches or bureaucracy.

- Two passive income streams: rental yield – every month once it has a tenant, capital growth – once the property is exited – sold;

- The capital growth is not capped, and you can earn even more than estimated;

Rental projects explained

Rental project is the investment type where we purchase the property and rent it out to reputable tenants. Normally this is a long-term duration project, as we are interested in providing the highest capital growth possible for our investors and it doesn’t happen overnight. Therefore, we are not rushing with the selling process and rather help the property to gain value, for example by renovating it.

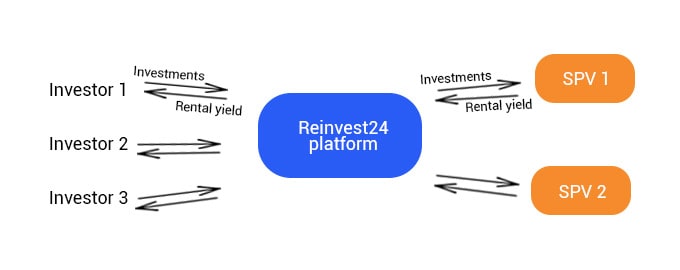

To be legally correct, it is an SPV (Special purpose vehicle company) that owns the property. After the project is financed, we create an SPV which buys it and rents it out. Our team manages all the processes, starting from finding tenants, making renovation works and organizing the selling process of it.

The same benefits as owning the property

The concept is similar to REITs, but in our case, it’s a loan with an ownership characteristic.

Why? This way we can provide investors with the same benefits and security as owning a part of the property, without forwarding any liabilities of it.

The amount of energy, effort and manpower that your real estate project requires can be overwhelming. It’s a very time-consuming process, especially if your goal is to outperform the overall market average. Every rental project needs to find a tenant, take care of all the household issues and undergo any necessary renovations. You also need to pay attention to all the legal matters, including contracts, permits, licenses and permissions. Not so passive anymore, right?

Besides, if we would consider here the ownership structure, it would mean that every investor, who would invest in this property would need to visit the notary appointments every time when required. Now imagine scheduling a perfect time for 2,000 investors. In that case, it would not make sense to provide investments starting with only 100 EUR. Moreover, the secondary market feature as such would not be possible at all.

The yield and the capital growth

Now let’s talk about why the rental projects have yield and capital growth? The first one is a rental yield that you start receiving monthly once the projects have a tenant. This source of passive income is key to creating long-term wealth as it will withstand market fluctuations, ensuring a better cash flow. The second one is capital growth, which investors receive once the property is exited – sold. As simple as that.

To have an even better understanding, let’s look at the numbers. For instance, we want to invest in a rental project from Germany – Eberswalde. Its rental yield is 6.5% and capital growth is 6%.

As You can see in the screenshot above, investing 10.000 EUR earns you 650 EUR per year as monthly payouts, which you can increase even more if reinvesting Your payouts.

Read more about How reinvesting at Reinvest24 can increase your returns even more

Additionally, once we sell the project you receive the rest of 600 EUR per year. In the case of Eberswalde, the capital growth is pre-agreed. It means that its capital growth will generate 6% annually. If You will hold the investment for 2 years – it will be twice higher. Please, bear in mind that in other projects capital growth is only estimated. Even though for its estimation we take an average market growth, our experience shows that capital growth might be even higher, as it has no cap.

No cap on capital growth

And that’s the beauty of this investment type. The upside is not capped, as it is, for example, with our real estate backed loans or development projects.

This is a strong argument, as considering the current worldwide events and the fact that Central Banks are printing a lot of new money, it will result in huge inflation in the upcoming years. It means that there will be growth in prices for raw materials and energy. Which will result in the growth of real estate prices as well.

Let’s take, for example, our developing market Moldova. Recently we have seen there a huge capital growth on the properties, that has been even bigger than the 15% interest. In the case of real estate backed loans, the capital growth is not present as in this case we give the financing to a third party. The good thing is that we are looking for a possibility to expand our rental project offering also in Moldova.

Read more about Moldova: The pandemic turned the Moldovan real estate market into a field of dreams - how & why?

Duration of the project

These are the only projects that have not a specified duration, as we simply cannot predict at the beginning when we will exit it. As already mentioned, If there is no urge for selling it, we will hold it until the best offer comes in and we are able to sell it with great capital growth for our investors. As our previous exits have shown, we are holding the property for 2-3 years.